In today’s rapidly evolving digital landscape, a robust online presence is crucial for the success of any e-commerce business. A core component of this online presence is the payment gateway, the technology that facilitates secure and efficient online transactions. This comprehensive guide aims to demystify payment gateways, providing e-commerce businesses with the knowledge they need to choose the right solution for their specific needs. Understanding the intricacies of payment processing, transaction fees, and security protocols is essential for optimizing sales conversions and building customer trust. This guide will delve into these key aspects, offering valuable insights into the world of online payment gateways.

From small startups to large enterprises, selecting the appropriate payment gateway can significantly impact revenue generation and operational efficiency. This guide will cover a range of topics related to payment gateways, including different payment gateway types, key features to consider, and best practices for implementation. We’ll explore the benefits of various payment gateway solutions, helping you navigate the complexities of online payments and empowering you to make informed decisions for your e-commerce business. Whether you’re processing domestic or international transactions, this guide will equip you with the tools you need to successfully integrate a payment gateway and optimize your e-commerce operations.

What is a Payment Gateway and Why is it Essential?

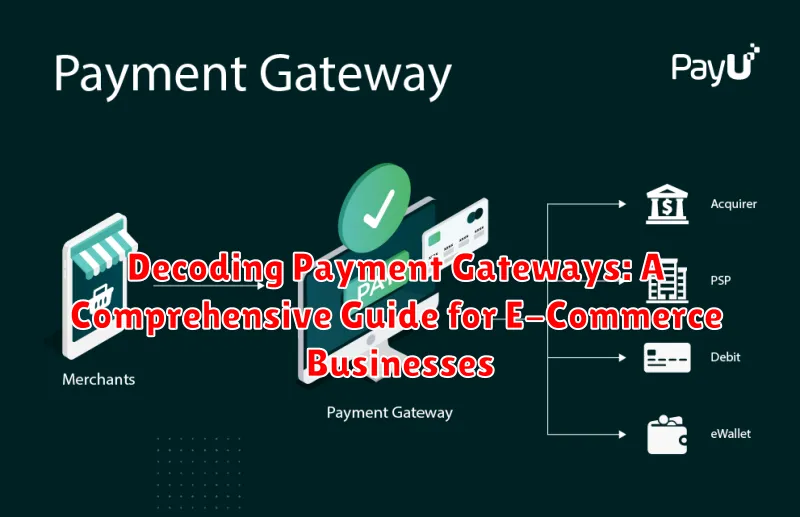

In the simplest terms, a payment gateway is the bridge that connects your online store to the payment processor. It securely authorizes credit card and other electronic payments for e-commerce transactions. Think of it as the digital equivalent of a physical point-of-sale terminal in a brick-and-mortar store.

When a customer completes a purchase online, the payment gateway securely transmits the transaction information to the payment processor for authorization. Once approved, the funds are transferred from the customer’s account to the merchant’s account.

Payment gateways are essential for e-commerce businesses for several reasons. They provide a secure way to process payments, minimizing the risk of fraud. They also automate the payment process, reducing manual work and improving efficiency. Furthermore, a payment gateway offers customers a seamless checkout experience, increasing customer satisfaction and conversion rates.

Types of Payment Gateways: Exploring the Options

Payment gateways come in various forms, each catering to different business needs. Understanding these distinctions is crucial for selecting the right solution.

Hosted Payment Gateways

With hosted payment gateways, customers are redirected to a third-party page to complete their transaction. This option simplifies PCI compliance for merchants but can slightly disrupt the customer experience. Examples include PayPal and Stripe Checkout.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to complete payments directly on your website, offering a seamless checkout experience. However, they require more robust security measures and PCI DSS compliance efforts. Authorize.Net and Worldpay are popular examples.

API Hosted Payment Gateways

API hosted gateways blend the best of both worlds. Merchants leverage APIs to control the payment process while integrating directly with the gateway’s infrastructure. This offers flexibility and customization. Braintree and Adyen are key players in this space.

Local Bank Integrators

These gateways directly connect your online store to a local bank’s payment processing system. They often provide localized payment options but may have limited international functionality.

Choosing the Right Payment Gateway for Your Business

Selecting the right payment gateway is crucial for a smooth and secure checkout experience. Several factors influence this decision, ensuring alignment with your business needs and customer expectations.

Transaction Fees are a primary concern. Different gateways have different fee structures, including per-transaction fees, monthly fees, and setup fees. Analyze your sales volume to determine the most cost-effective option.

Supported Payment Methods are another key factor. Consider your target audience and the payment methods they prefer. Ensure the gateway supports major credit and debit cards, as well as any alternative payment methods relevant to your customer base.

Integration with Your Platform is essential for seamless operation. Choose a gateway that easily integrates with your e-commerce platform or website builder. This simplifies setup and minimizes technical challenges.

Security Features are paramount for protecting sensitive customer data. Look for gateways that offer robust security measures, including PCI DSS compliance, fraud prevention tools, and data encryption.

Security Considerations: Protecting Customer Data

Security is paramount when handling sensitive customer payment information. Choosing a payment gateway with robust security measures is crucial for protecting your business and your customers.

PCI DSS Compliance is a mandatory requirement for any business processing card payments. This standard ensures the secure handling of cardholder data at every stage. Verify that your chosen gateway is PCI DSS compliant.

Encryption methods, such as SSL and TLS, safeguard data transmitted between the customer, your website, and the payment gateway. Look for gateways utilizing strong encryption protocols.

Tokenization replaces sensitive card data with unique tokens, reducing the risk of exposure. Tokenization adds an extra layer of security, protecting data even if a breach occurs.

Fraud prevention tools like address verification (AVS) and card security code (CSC) checks help minimize fraudulent transactions and protect your business from losses.

Regular security audits and vulnerability assessments are essential to identify and address potential weaknesses. Choose a provider that demonstrates a commitment to proactive security measures.

Integrating a Payment Gateway with Your Online Store

Integrating a payment gateway is crucial for accepting online payments. The integration process generally involves working with your chosen gateway provider and potentially a developer, if necessary. There are typically two primary integration methods: hosted payment gateways and direct payment gateways.

Hosted Payment Gateways

With a hosted payment gateway, customers are redirected to the provider’s secure checkout page to enter their payment information. After completing the transaction, they are redirected back to your online store. This method simplifies integration and reduces PCI DSS compliance burdens.

Direct Payment Gateways

Direct payment gateways allow customers to enter payment information directly on your website, offering a more seamless checkout experience. This method often requires more technical expertise and carries greater security responsibilities due to handling sensitive data.

Regardless of the method chosen, ensure your integration is thoroughly tested to guarantee a smooth and secure checkout process for your customers.

Understanding Payment Gateway Fees and Charges

Navigating the landscape of payment gateway fees is crucial for any e-commerce business. Understanding these costs helps businesses accurately project profits and optimize pricing strategies. Several key fee types typically come into play.

Transaction fees are charged per sale. These are often a percentage of the transaction amount plus a fixed fee. For example, a gateway might charge 2.9% + $0.30 per transaction.

Monthly fees are a fixed cost for using the gateway’s services. These can vary widely depending on the gateway provider and the features included.

Other fees may include chargeback fees, assessed when a customer disputes a charge, and setup fees, a one-time charge for establishing an account.

Comparing different gateway providers and their fee structures is essential. Choosing the right gateway depends on factors like transaction volume, average transaction value, and required features.

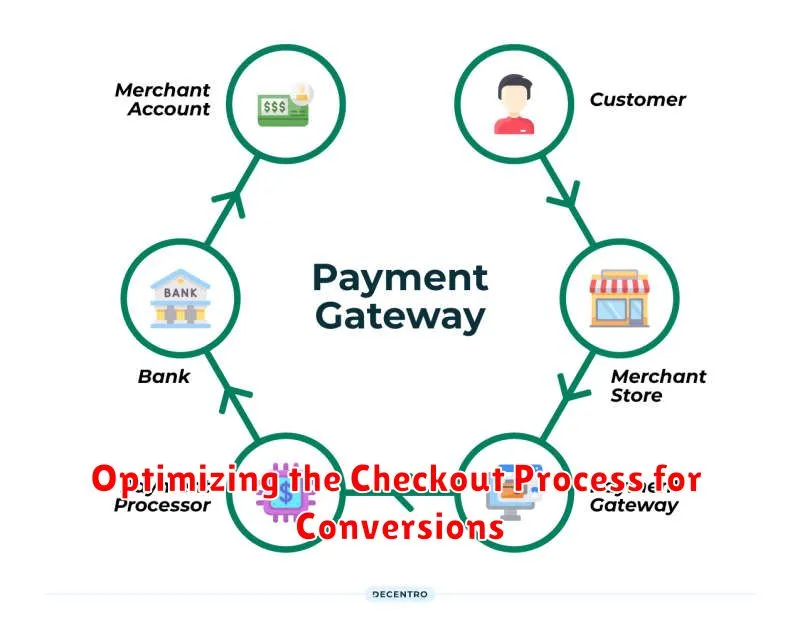

Optimizing the Checkout Process for Conversions

A streamlined and user-friendly checkout experience is crucial for maximizing conversions. Minimize the number of steps required to complete a purchase. Each additional click or form field can lead to cart abandonment.

Offer guest checkout options. Requiring account creation can deter customers who prefer a quick and easy purchase. While encouraging account creation offers benefits, don’t make it mandatory.

Clearly display security badges. Build trust and alleviate security concerns by showcasing recognized security logos like Norton Secured or McAfee Secure. This reassures customers that their payment information is safe.

Provide multiple payment options. Supporting various payment methods, such as credit cards, debit cards, digital wallets (e.g., Apple Pay, Google Pay), and even buy now, pay later services, caters to a wider customer base and increases conversion potential.

Optimize for mobile devices. Ensure your checkout process is fully responsive and functions seamlessly on smartphones and tablets. A mobile-friendly experience is essential in today’s e-commerce landscape.

Troubleshooting Common Payment Gateway Issues

Encountering payment gateway issues can be frustrating for both businesses and customers. Swiftly addressing these problems is crucial for maintaining a smooth checkout experience.

One common issue is transaction declines. These can occur for various reasons, such as insufficient funds, incorrect card details, or security flags. Advise customers to double-check their information and contact their bank if the problem persists. From a business perspective, ensure your payment gateway integration is correct and that you’re handling declined transactions gracefully.

Another frequent problem is connectivity issues. Network outages or server problems can interrupt transactions. Have a backup plan in place, and consider using a payment gateway with high availability and redundancy. Regularly monitor your gateway’s performance to proactively identify potential issues.

Authorization failures are another hurdle. These happen when a card issuer declines a transaction, even if the customer has sufficient funds. Reasons can range from security concerns to exceeding credit limits. Encourage customers to contact their card issuer directly to resolve these matters.