Running a successful online business requires a robust and secure payment processing system. Understanding the difference between payment gateways and merchant accounts is crucial for choosing the right setup. This guide will decode the complexities of payment gateways versus merchant accounts, providing a clear understanding of how each functions within the broader context of online payment processing. We’ll explore the essential roles they play in facilitating seamless and secure transactions for your online business, allowing you to make informed decisions that optimize your e-commerce operations and enhance customer experience.

Choosing between different payment gateway providers and merchant account options can feel overwhelming. This article provides a comprehensive breakdown of the key differences between payment gateways and merchant accounts. We’ll explore their respective functionalities, advantages, and disadvantages, providing a clear guide to help online businesses like yours navigate the landscape of online payment processing. By the end, you’ll be equipped with the knowledge necessary to select the optimal payment processing solution for your specific needs and grow your e-commerce presence effectively.

Understanding the Basics of Online Payments

For online businesses, accepting payments seamlessly is crucial for success. This involves a complex yet efficient system working behind the scenes. When a customer makes a purchase online, several steps occur to transfer funds securely from their account to the business’s account. This process relies on key players, including payment gateways and merchant accounts.

Think of an online transaction like this: a customer adds items to their cart and proceeds to checkout. They enter their payment information, which is securely transmitted for authorization. The funds are then transferred and settled into the business’s account, allowing them to receive the payment. This entire flow requires secure channels and intermediaries to ensure a smooth and protected transaction.

Understanding how these components interact is essential for any business owner accepting online payments. It allows for informed decisions regarding payment processing, ultimately contributing to a positive customer experience and efficient business operations.

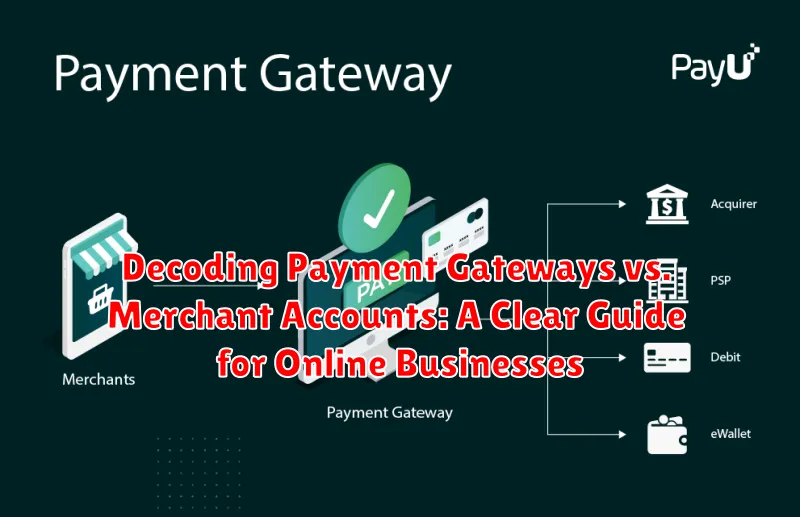

What is a Payment Gateway?

A payment gateway is the digital equivalent of a physical point-of-sale terminal in a brick-and-mortar store. It’s the technology that securely authorizes credit card and other electronic payments for online and e-commerce transactions.

Think of it as the bridge that connects your customer’s payment information (credit card number, expiration date, etc.) to your merchant account and the payment processor.

When a customer makes a purchase online, the payment gateway encrypts the sensitive data and transmits it securely for processing. It then returns the transaction results (approved or declined) back to your website.

Crucially, the gateway itself doesn’t process the funds. Instead, it facilitates the secure transfer of payment information for authorization and settlement via the payment processor.

How Payment Gateways Work

A payment gateway acts as a bridge, securely transmitting transaction data between your online store and the payment processor. Think of it as the digital equivalent of a physical point-of-sale terminal.

The process begins when a customer initiates a purchase on your website. After entering their payment information, the gateway encrypts the data and sends it to the payment processor for authorization.

The payment processor then communicates with the customer’s issuing bank to verify the funds. Once approved, the processor relays the confirmation back to the payment gateway, which then informs your website and the customer about the successful transaction.

This entire process happens within seconds, allowing for a smooth and efficient checkout experience.

Key steps in the payment gateway process:

- Customer enters payment information.

- Gateway encrypts and transmits data.

- Payment processor requests authorization.

- Issuing bank verifies funds.

- Confirmation relayed back to the merchant.

What is a Merchant Account?

A merchant account is a special type of bank account that allows businesses to accept payments via credit and debit cards. Think of it as a holding area for customer funds before they’re transferred to your business’s regular checking account. It’s essential for processing online payments as it acts as the intermediary between your business, the customer’s bank, and the payment gateway.

When a customer makes a purchase online, the funds are first deposited into your merchant account. From there, after processing fees are deducted, the funds are then transferred to your business bank account, typically within a few business days. Having a merchant account provides credibility and security, demonstrating to customers and financial institutions that your business is legitimate and capable of handling online transactions.

Merchant accounts are usually established through acquiring banks that specialize in handling credit card transactions. These banks assess your business risk and set up the necessary procedures for securely processing payments. The application process typically involves providing information about your business, including financial statements and processing history.

Why You Need Both a Payment Gateway and a Merchant Account

While seemingly similar, payment gateways and merchant accounts serve distinct yet interconnected roles in online transactions. They work together to provide a seamless and secure payment experience for both businesses and customers. Think of it like this: the payment gateway is the bridge, while the merchant account is the destination.

A merchant account is essential because it provides a dedicated space for your business to securely receive customer payments. It acts as a holding area for funds before they are transferred to your business bank account. This separation is crucial for managing risk and ensuring financial stability.

The payment gateway, on the other hand, is the technology that facilitates the actual transfer of funds. It authorizes the transaction, encrypts sensitive data, and transmits the payment information securely between the customer, the merchant, and the payment processor. Without a gateway, the transaction cannot be initiated or completed.

In essence, the gateway processes the payment while the merchant account receives it. Both components are necessary for accepting and processing online payments efficiently and securely.

Choosing the Right Payment Gateway and Merchant Account for Your Business

Selecting the right payment gateway and merchant account is crucial for your online business’s success. Consider these key factors to make the best choice:

Transaction Fees

Processing fees vary between providers. Compare costs like per-transaction fees, monthly fees, and chargeback fees. Choose a structure that aligns with your sales volume and average transaction value.

Supported Payment Methods

Ensure the gateway supports the payment methods your customers prefer. This may include major credit cards, debit cards, digital wallets, and even international payment options depending on your target market.

Integration with Your Platform

Seamless integration with your existing e-commerce platform simplifies setup and streamlines transactions. Check for compatibility with your chosen platform before committing to a provider.

Security Features

Security is paramount. Look for gateways with robust fraud prevention tools and advanced security protocols like PCI DSS compliance to protect sensitive customer data.

Customer Support

Reliable customer support is essential for troubleshooting technical issues and addressing any payment processing concerns promptly. Evaluate the provider’s availability and support channels.

Benefits of Using a Payment Gateway and Merchant Account

Leveraging both a payment gateway and a merchant account offers numerous advantages for online businesses. These tools streamline transactions and enhance the overall customer experience. Here are some key benefits:

Improved Security

Enhanced security measures protect sensitive customer data during transactions. Payment gateways employ encryption and tokenization, reducing the risk of fraud and data breaches. This builds trust with customers and safeguards your business reputation.

Increased Sales

Offering multiple payment options caters to a wider customer base. Accepting various credit and debit cards, and even digital wallets, expands your reach and increases potential sales. A seamless checkout experience encourages conversions and reduces cart abandonment.

Faster Processing

Automated transaction processing minimizes manual intervention, leading to faster payments. This improves cash flow and reduces administrative overhead. Real-time transaction monitoring allows for quick issue resolution and efficient reconciliation.

Global Reach

Expand your business internationally by accepting payments from customers worldwide. Payment gateways facilitate cross-border transactions, opening up new markets and revenue streams.

Common Misconceptions about Payment Gateways and Merchant Accounts

Several misconceptions surround payment gateways and merchant accounts, often leading to confusion for businesses. Let’s clarify some common misunderstandings.

Misconception 1: They Are the Same Thing

A common mistake is believing payment gateways and merchant accounts are interchangeable. In reality, they are distinct but interconnected components. A merchant account is a bank account that allows your business to accept credit and debit card payments. A payment gateway is the technology that securely authorizes and processes those transactions between your customer and your merchant account.

Misconception 2: Payment Gateways Store Funds

Another misconception is that payment gateways hold the funds from customer purchases. The merchant account is where the funds are deposited. The payment gateway simply acts as a conduit for the transaction.

Misconception 3: All Gateways Offer the Same Features

Not all payment gateways are created equal. They vary in terms of processing fees, features offered, and supported payment methods. It’s crucial to research and choose a gateway that aligns with your specific business needs.