In today’s digital landscape, a robust online presence is crucial for business success. For e-commerce businesses, this means having a streamlined and secure payment process. This comprehensive guide explores the world of e-commerce payment gateways, providing valuable insights for online businesses seeking to optimize their checkout experience and boost conversions. Understanding the various types of payment gateways, their features, and their integration processes is essential for selecting the right solution for your specific business needs. This guide will cover key aspects of online payment processing, including security considerations, payment gateway fees, and emerging trends in the industry. Whether you are a startup or an established enterprise, choosing the right payment gateway can significantly impact your bottom line.

This guide delves into the complexities of e-commerce payment gateways, offering a clear and concise overview of how they function, the benefits they offer, and the factors to consider when making a selection. From merchant accounts to payment processing, we’ll cover the essential components of a secure and efficient online transaction. Learn how to choose a payment gateway that aligns with your business model, target audience, and technical requirements. We will also discuss the importance of PCI compliance and the latest security measures to protect your business and your customers from fraud. By the end of this guide, you will be equipped with the knowledge to make informed decisions about e-commerce payment gateways and optimize your online business for success.

What is a Payment Gateway and How Does It Work?

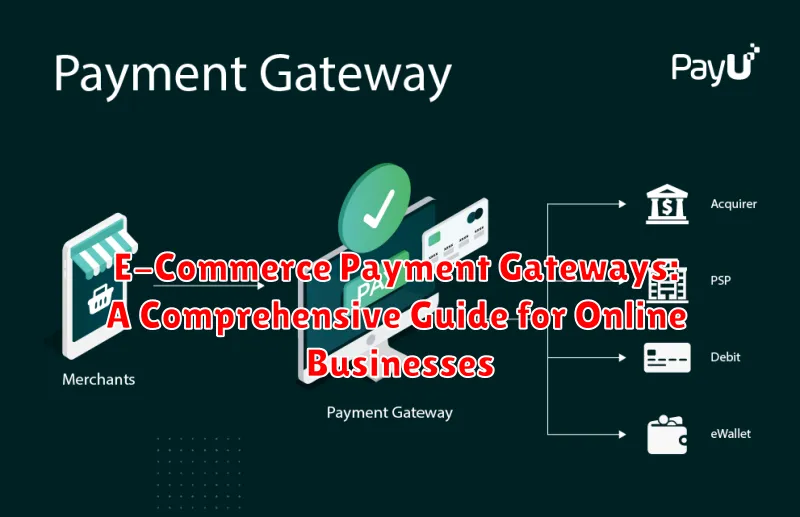

A payment gateway is a critical component of online businesses, acting as a bridge between your online store and the payment processor. It securely authorizes credit card and other electronic payments for e-commerce transactions.

Think of it like this: when a customer makes a purchase, the payment gateway securely collects their payment information. It then transmits this data to the payment processor for verification and approval. Finally, the gateway transmits the transaction status back to your website, allowing you to complete the order.

This entire process happens seamlessly and quickly, typically within a few seconds, providing a smooth and secure checkout experience for the customer.

Key Roles of a Payment Gateway:

- Encryption: Protecting sensitive payment data during transmission.

- Authorization: Verifying the customer’s ability to pay.

- Settlement: Facilitating the transfer of funds to your merchant account.

Types of Payment Gateways Available for E-Commerce

Several types of payment gateways cater to different business needs. Understanding their distinctions is crucial for selecting the optimal solution.

Hosted Payment Gateways

With hosted gateways, the customer is redirected to a third-party payment page to complete the transaction. This simplifies PCI compliance for merchants but can create a less seamless customer experience.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to enter payment information directly on the merchant’s website. This offers greater control over branding and user experience, but increases security responsibilities.

Direct Post Payment Gateways

Direct post gateways send transaction data directly to the payment processor. This method can be more efficient than hosted gateways, while offering more control than self-hosted solutions.

Local Bank Integrators

Local bank integrators redirect customers to their respective bank’s online banking portal for payment. These are common in specific regions and provide a familiar payment experience for local customers.

Choosing the Right Payment Gateway for Your Needs

Selecting the appropriate payment gateway is crucial for a seamless checkout experience and successful online business. Several factors should be considered to ensure the chosen gateway aligns with your specific requirements.

Transaction Fees are a primary concern. Different gateways have varying fee structures, including per-transaction fees, monthly fees, and setup fees. Carefully evaluate these costs to determine the most cost-effective solution for your business model.

Supported Payment Methods are another essential consideration. Ensure the gateway supports the payment options your target audience prefers. This might include credit cards, debit cards, digital wallets, or alternative payment methods popular in your region.

Security features are paramount. Choose a gateway with robust security measures such as PCI DSS compliance, fraud prevention tools, and data encryption to protect your business and customer data.

Integration Capabilities are also key. The chosen gateway should seamlessly integrate with your existing e-commerce platform and other business tools to simplify operations and streamline workflows. Consider the technical expertise required for implementation and ongoing maintenance.

Security Considerations for Online Payments

Security is paramount when processing online payments. PCI DSS compliance is crucial. This standard mandates security measures for handling cardholder data, including encryption, secure networks, and regular vulnerability scans. Choosing a PCI DSS compliant payment gateway significantly reduces your business’s risk.

Fraud prevention measures are also essential. Employ tools like address verification (AVS) and card security code (CVV) checks to validate transactions. Consider implementing 3D Secure (like Verified by Visa or Mastercard SecureCode) for added authentication. Monitoring transactions for suspicious activity is also vital in identifying and preventing fraudulent purchases.

Data encryption is fundamental to secure online transactions. SSL/TLS encryption protects data transmitted between the customer’s browser and your server. Ensure your payment gateway uses robust encryption methods to safeguard sensitive information.

Integrating a Payment Gateway into Your Online Store

Integrating a payment gateway is a crucial step in setting up your e-commerce business. The integration process typically involves working with your chosen gateway provider and following their specific instructions. However, several common steps generally apply.

Choosing an Integration Method

You’ll typically choose between direct integration or using a plugin/extension. Direct integration offers greater control and customization but requires more technical expertise. Plugins or extensions simplify the process, especially for popular e-commerce platforms.

Key Steps in the Integration Process

- Sign Up: Create an account with your chosen payment gateway provider.

- Obtain API Keys: These credentials allow your online store to communicate securely with the gateway.

- Installation/Configuration: Install necessary plugins or configure the API connection within your store’s platform.

- Testing: Thoroughly test transactions in a sandbox environment before going live to ensure smooth operation.

Post-Integration Considerations

After integrating, regularly monitor transactions and maintain communication with your payment gateway provider for any updates or necessary adjustments.

Processing Payments Securely and Efficiently

Secure and efficient payment processing is the cornerstone of any successful e-commerce business. It builds trust with customers and ensures smooth financial operations. Choosing the right payment gateway is crucial for achieving this.

Security is paramount. Look for gateways that offer robust features like PCI DSS compliance, tokenization, and fraud prevention tools. These measures protect sensitive customer data and minimize the risk of fraudulent transactions.

Efficiency is equally important. A good payment gateway should offer a seamless checkout experience, supporting multiple payment methods and currencies. Fast processing times and automated transaction management are also essential for streamlining operations.

Consider factors like transaction fees, integration options, and customer support when evaluating different payment gateways. The right choice will depend on your specific business needs and target market.

Managing Transactions and Refunds

Efficient transaction and refund management is crucial for a positive customer experience and smooth business operations. Transaction management involves overseeing the entire payment process from the moment a customer initiates a purchase to when the funds are settled in your merchant account. This includes monitoring transaction status, identifying and resolving any payment issues, and reconciling transactions with your accounting systems.

Refund management is equally important. A streamlined refund process can build customer trust and loyalty. This involves establishing clear refund policies, processing refunds promptly, and communicating effectively with customers throughout the refund process. It also requires keeping accurate records of all refunds issued and monitoring for any fraudulent activity.

Utilizing a payment gateway with robust reporting and management tools simplifies these processes. These tools often allow businesses to view transaction details, generate reports, and manage refunds directly from their dashboard.

Understanding Payment Gateway Fees and Charges

Choosing the right payment gateway involves understanding the associated costs. Transaction fees are a core component, often charged per transaction as a percentage plus a fixed fee. These can vary based on factors like transaction volume and card type (credit, debit, etc.).

Setup fees may be charged for initial gateway integration. Monthly fees can cover services like account maintenance and customer support. Chargeback fees apply when a customer disputes a charge, often incurring a significant cost and administrative burden.

Other potential fees include refund processing fees, cross-border fees for international transactions, and PCI compliance fees to maintain secure data handling practices. Carefully review the fee structure of different payment gateways to select the most cost-effective solution for your business.

Improving Conversion Rates with Optimized Checkout Processes

A streamlined and user-friendly checkout experience is crucial for maximizing conversions. Reduce friction in the payment process to encourage customers to complete their purchases.

Minimize required fields. Only ask for essential information during checkout. Long forms can deter customers. Offer guest checkout options to avoid forcing account creation.

Clearly display payment options. Customers should easily see accepted payment methods. Prominently feature popular choices like major credit cards and digital wallets.

Optimize for mobile devices. Ensure your checkout process is fully responsive and functions flawlessly on smartphones and tablets. A mobile-friendly experience is paramount for capturing on-the-go shoppers.

Offer express checkout options. Services like Apple Pay or Google Pay can significantly speed up the payment process, reducing cart abandonment.

Future Trends in E-Commerce Payment Gateways

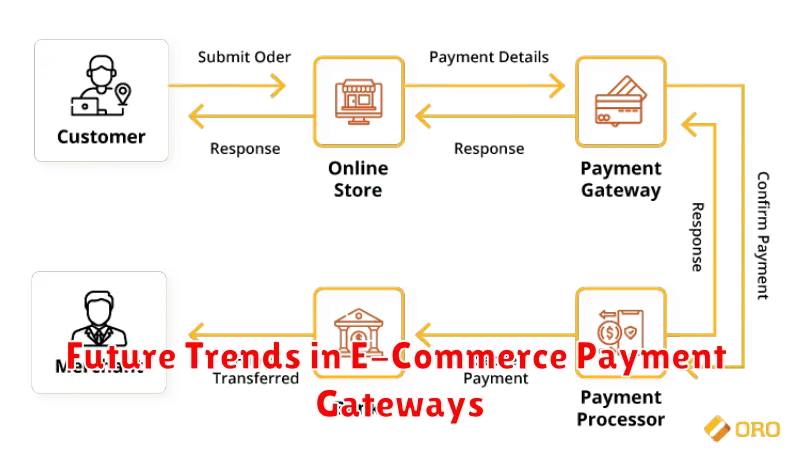

The landscape of e-commerce payment gateways is constantly evolving. Several key trends are shaping the future of online transactions, promising increased security, convenience, and efficiency for both businesses and consumers.

Invisible Payments are gaining traction, streamlining the checkout process by eliminating the need for explicit payment information entry. This frictionless approach leverages stored payment details and biometric authentication to authorize transactions seamlessly.

Mobile wallets continue to rise in popularity. These digital wallets offer a convenient way to store and manage payment information, facilitating quick and secure transactions on mobile devices and increasingly on desktop platforms.

The Internet of Things (IoT) is introducing new payment possibilities. Connected devices, from smart refrigerators to wearable technology, are enabling seamless and automated payments for a wide range of goods and services.

Blockchain technology and cryptocurrencies are poised to disrupt traditional payment systems. While still in its early stages, the potential for decentralized, secure, and transparent transactions is significant.

Artificial intelligence (AI) is playing a growing role in fraud prevention and risk management. AI-powered systems can analyze transaction data in real-time, identifying and flagging suspicious activity to protect both businesses and consumers.

Biometric authentication is becoming increasingly prevalent. Fingerprint scanning, facial recognition, and other biometric methods offer enhanced security and a more seamless user experience.